There is a lot of debate over whether or not Red Arrow Loans is a legitimate company. Some people say that they are a scam, while others claim that they are legitimate lenders. So, is Red Arrow Loans legit?

Recommended: What does loan to deposit ratio mean? What does it mean to backstop a loan?

1. Is Red Arrow Loans Legit?

Red Arrow Loans is a short-term lending company that offers loans of up to $1,000. The company is based in the UK and is a member of the Consumer Financial Protection Bureau (CFPB). Red Arrow Loans is not a direct lender but instead works with a network of lenders to provide loans to consumers.

The company offers two types of loans: short-term loans and installment loans. Short-term loans are typically repaid within 30 days, while installment loans are repaid over some time (usually 3-12 months).

Red Arrow Loans is a legitimate company that is regulated by the CFPB. The company has a good reputation and is generally seen as a reliable source of short-term funding. However, as with any lending company, there are some risks involved in taking out a loan with Red Arrow Loans.

The main risk is that of defaulting on the loan. If you cannot repay the loan, you will be responsible for the full amount of the loan plus interest and fees. This can lead to financial difficulties and even bankruptcy.

Another risk is that of taking out a loan that you cannot afford. Be sure to only borrow an amount that you can realistically afford to repay. Failure to do so could lead to financial hardship.

Overall, Red Arrow Loans is a legitimate company that can provide you with the funds you need in a short amount of time. However, as with any lending company, there are some risks involved. Be sure to carefully consider these risks before taking out a loan with Red Arrow Loans.

2. What are Red Arrow Loans?

Red Arrow Loans is a direct lender that offers installment loans to consumers with bad credit. The company is based in Arizona and has been in business since 2014. The company offers loans of up to $5,000 with terms of up to 24 months. Loan repayment is made in equal monthly installments.

The company does not have a minimum credit score requirement but does consider factors such as employment history and monthly income when making lending decisions. Red Arrow Loans does not require a down payment or collateral. The company charges an origination fee of 5% of the loan amount and has an APR of 99% to 155%.

Red Arrow Loans is not accredited by the Better Business Bureau but has an A+ rating. The company has a Trustpilot score of 9.2/10 based on over 3,000 reviews.

Red Arrow Loans is a direct lender that offers installment loans to consumers with bad credit. The company is based in Arizona and has been in business since 2014. The company offers loans of up to $5,000 with terms of up to 24 months. Loan repayment is made in equal monthly installments.

The company does not have a minimum credit score requirement but does consider factors such as employment history and monthly income when making lending decisions. Red Arrow Loans does not require a down payment or collateral. The company charges an origination fee of 5% of the loan amount and has an APR of 99% to 155%.

Red Arrow Loans is not accredited by the Better Business Bureau but has an A+ rating. The company has a Trustpilot score of 9.2/10 based on over 3,000 reviews.

Red Arrow Loans is a direct lender that offers installment loans to consumers with bad credit. The company is based in Arizona and has been in business since 2014. The company offers loans of up to $5,000 with terms of up to 24 months. Loan repayment is made in equal monthly installments.

The company does not have a minimum credit score requirement but does consider factors such as employment history and monthly income when making lending decisions. Red Arrow Loans does not require a down payment or collateral. The company charges an origination fee of 5% of

3. How Do Red Arrow Loans Work?

Red Arrow Loans is a short-term lending service that offers quick and easy access to cash when you need it most. The application process is simple and takes just a few minutes to complete. Once approved, you can expect to receive your cash within 24 hours.

What makes Red Arrow Loans different from other lenders is that they offer a flexible repayment schedule. You can choose to repay your loan over a period that suits you, making it more affordable and manageable.

If you’re facing unexpected expenses or need some extra cash to tide you over until payday, Red Arrow Loans could be the solution you’re looking for.

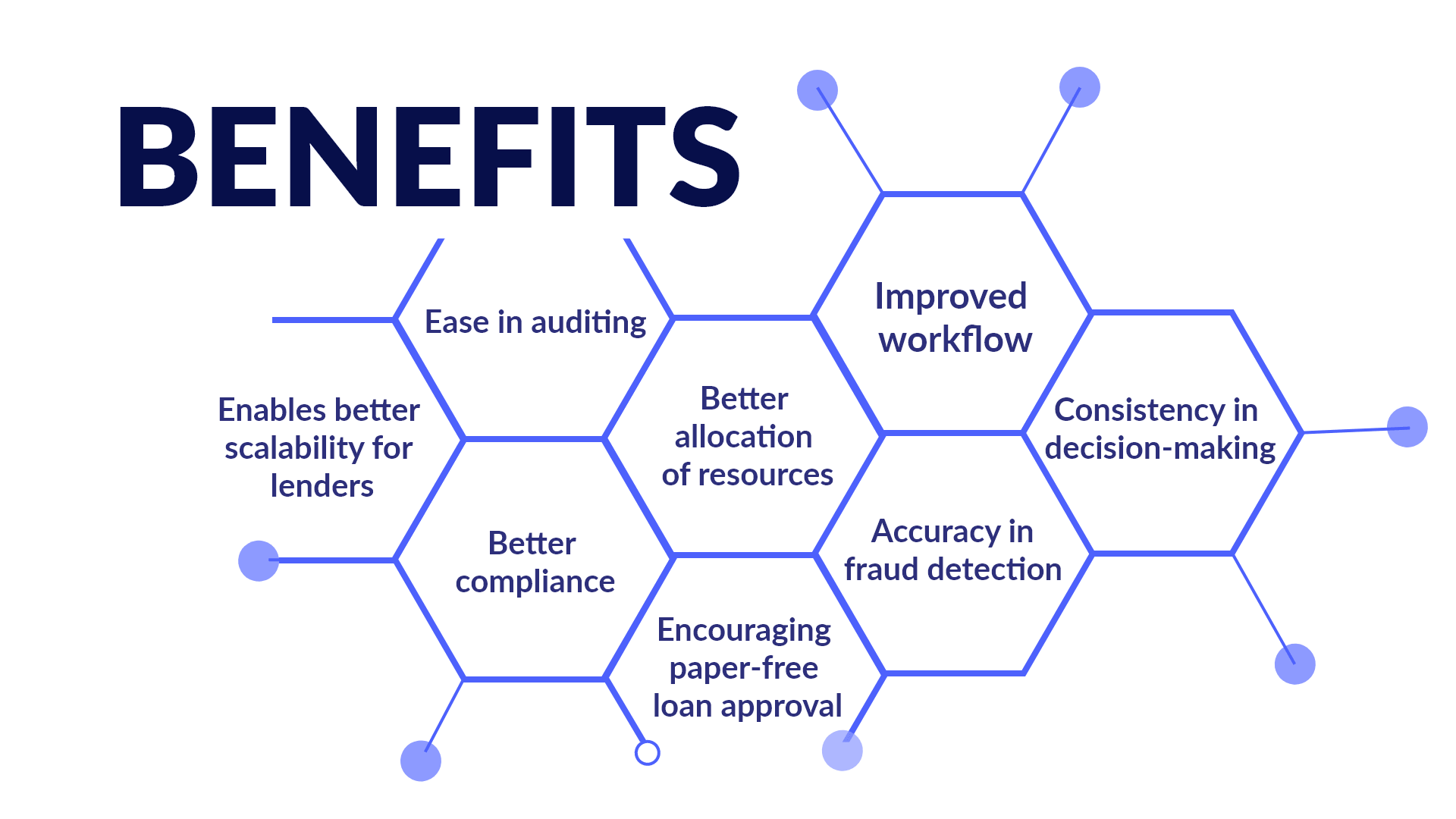

4. What Are the Advantages of Red Arrow Loans?

Red Arrow Loans is a lending platform that offers personal loans and lines of credit to qualified borrowers. There are many advantages to using Red Arrow Loans, including:

1. Fast and easy application process: Applying for a loan or line of credit with Red Arrow Loans is quick and easy. You can apply online in just a few minutes, and you will typically receive a decision within 24 hours.

2. Competitive interest rates: Red Arrow Loans offers some of the most competitive interest rates on the market. This means you can save money on your loan or line of credit, and pay it off more quickly.

3. No hidden fees: There are no hidden fees with Red Arrow Loans. You will know exactly what you are paying before you agree to the loan or line of credit.

4. Flexible repayment terms: Red Arrow Loans offers flexible repayment terms to suit your needs. You can choose a repayment plan that works for you, and you can make early repayments without penalty.

If you are looking for a personal loan or line of credit, Red Arrow Loans is a great option to consider. With its competitive interest rates and flexible repayment terms, it is an ideal way to finance your needs.

5. What Are the Disadvantages of Red Arrow Loans?

If you’re considering taking out a Red Arrow loan, it’s important to be aware of the potential disadvantages before you make your decision. Here are five things to keep in mind:

1. High-Interest Rates

Red Arrow loans come with high-interest rates, which can make them difficult to repay. If you’re not careful, you could end up paying back far more than you borrowed.

2. Short Repayment Terms

Red Arrow loans typically have short repayment terms, which can make them difficult to manage. If you’re not able to repay your loan in full and on time, you could be charged late fees or penalties.

3. Limited Loan Amounts

Red Arrow loans typically have low loan limits, which can make them less useful for borrowers who need to borrow large amounts of money.

4. No Pre-Payment Options

Red Arrow loans do not typically offer pre-payment options, which means you’ll be required to repay your loan in full even if you’re able to do so earlier.

5. Potential for Fraud

There have been some reports of fraud associated with Red Arrow loans. If you’re considering taking out a loan from this lender, be sure to do your research and only work with a reputable company.

6. How to Apply for Red Arrow Loans?

If you need quick cash and have bad credit, you may be considering a Red Arrow loan. But are they legitimate? And if so, how do you apply for one?

Red Arrow Loans is a legitimate company that offers short-term loans to people with bad credit. They are a member of the Online Lenders Alliance and are accredited by the Better Business Bureau.

To apply for a Red Arrow loan, you must be at least 18 years old and have a regular source of income. You will also need to provide some basic personal and financial information.

Once you’ve submitted your application, Red Arrow will review your information and decide within 24 hours. If you’re approved, you’ll typically receive your loan funds within one to two business days.

Before you apply for a Red Arrow loan, be sure to read the terms and conditions carefully. These loans come with high-interest rates and fees, so they’re not right for everyone. If you’re not sure you can repay your loan on time, you may want to consider another option.

7. Conclusion

When it comes to taking out a loan, there are a lot of things to consider. You want to make sure you are getting the best possible deal, with the lowest interest rate and fees. You also want to be sure that the company you are working with is legitimate. There are a lot of loan companies out there, and not all of them are on the up and up. So, is Red Arrow Loans legit?

The short answer is yes, Red Arrow Loans is a legitimate company. They are a direct lender, which means they will work with you directly to get you the loan you need. They offer a variety of loans, including personal loans, auto loans, and home equity loans. They have an A+ rating with the Better Business Bureau, and they are accredited with them. They have been in business since 2014 and have helped thousands of people get the loans they need.

When you are considering taking out a loan, you want to be sure you are working with a legitimate company. Red Arrow Loans is a direct lender that has a variety of loans to choose from. They are accredited by the Better Business Bureau and have an A+ rating. They have been helping people get the loans they need since 2014. You can be confident that you are working with a legitimate company when you choose Red Arrow Loans.

Leave a Reply