A mortgage call report is a document that is produced after a mortgage company has conducted a mortgage call. It contains important information about the loan that was approved.

Recommended: What not to do when applying for a mortgage? Will debt management affect my mortgage?

1. What is a mortgage call report?

A mortgage call report is a report that lenders use to track a borrower’s mortgage payments. The report includes information on the borrower’s payment history, as well as the current status of the loan. Lenders use mortgage call reports to determine whether a borrower is making timely payments and to assess the risk of the loan.

2. The purpose of a mortgage call report

A mortgage call report is a report that lenders use to track the progress of a loan. The report includes information on the borrower’s payment history, the status of the property, and the loan’s current balance. The report also includes information on the lender’s contact with the borrower and any changes to the loan’s terms.

3. How often is a mortgage call report filed?

A mortgage call report is filed every quarter by banks and other financial institutions that extend mortgage loans. The report includes information on the number of loans outstanding, the delinquency rate, and the average loan balance. The report is used by regulators to monitor the health of the mortgage industry and to identify potential problems.

4. What information is included in a mortgage call report?

A mortgage call report is a document that provides information on the status of a mortgage loan. The report includes the loan balance, payment history, and other information that can be used to determine the loan’s status.

5. How is a mortgage call report used?

A mortgage call report is a type of financial report that provides information on the current status of a mortgage loan. The report includes information on the loan amount, interest rate, payment history, and any other pertinent information. Mortgage call reports are used by lenders to assess the risk of a loan and to determine whether or not to continue funding the loan.

6. What are the benefits of a mortgage call report?

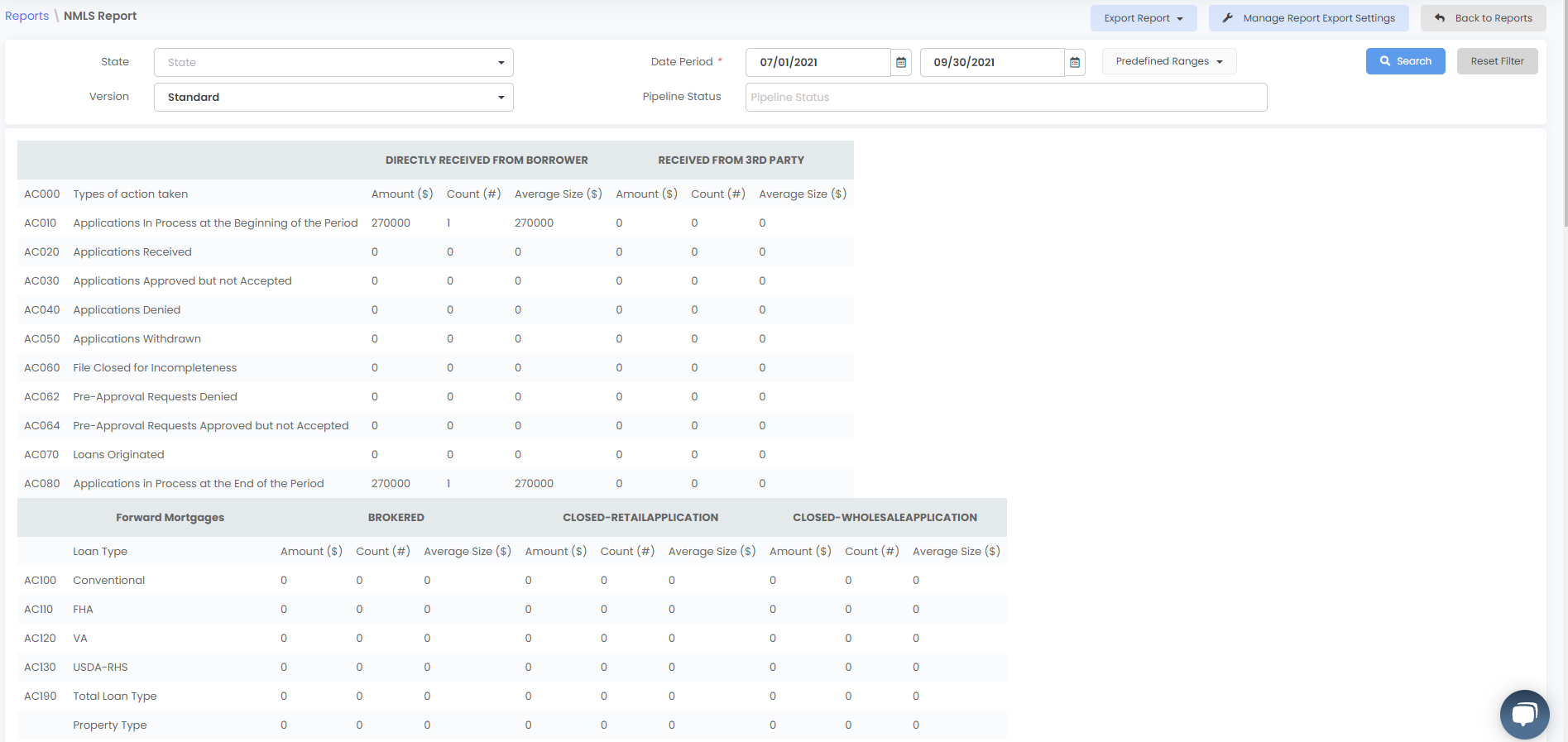

A mortgage call report is a report that is required to be filed by all mortgage loan originators with the Nationwide Mortgage Licensing System & Registry (NMLS). The report includes information about the loan originator’s business activities for the previous month.

The purpose of the mortgage call report is to provide regulators with information about the loan originator’s business activities. The report helps regulators identify trends and monitor compliance with state and federal laws.

The information included in the mortgage call report includes:

– The number of loan applications received

– The number of loan applications approved

– The number of loan applications denied

– The number of loans originated

– The number of loans sold

– The number of loans serviced

– The number of complaints received

The mortgage call report is filed electronically through the NMLS website. Loan originators must file a report for each state in which they are licensed to originate loans.

The benefits of the mortgage call report include:

– Increased transparency of the loan originator’s business activities

– Helps regulators identify trends and monitor compliance

– Provides data that can be used to improve the loan origination process